Kai Xin 00:07

Money is the root of all evil. Growing up in an Asian family this belief was planted in my mind since I was very little TV dramas we portray fights among family members over inheritance, business partners falling out because of money disputes, or crimes committed due to greed. Individuals losing their friends, after gaining massive amount of wealth and the list just goes on. Money almost feels like a bad word. I was taught to be content with the little I have because more money seems to bring more trouble and that money can buy happiness. However, is that really the case? What if there is a way to be financially wealthy, yet spiritually happy?

Hi, I’m Kai Xin, your host for this episode and you’re listening to the Handful Of Leaves podcast where we bring you practical Buddhist wisdom for a happier life. The path to happiness isn’t a smooth one, we’ll definitely meet with setbacks and challenges around work, relationships, mental well being and so many more. In this podcast, we discuss these realities of life and explore how we can bring the Dhamma closer to home so that we can navigate the complexities of life just a little better. Besides this podcast, we also share resources and insights on our Instagram, Facebook and telegram channel. Subscribe if you haven’t already done so.

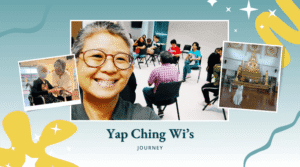

In this episode, I have the honour to speak with Seow Kek Wee, commonly referred to as the Grey Rhino. Kek Wee is the Head of Investment Research of Unicorn Financial Solutions, advising and managing assets in excess of $0.5 billion. If you’re interested in leading a happy life with money as the fuel these episode is for you. There are so many mind shifting moments that really got me thinking about my relationship with money. I also appreciate the practical insights on how I can grow my wealth without compromising my happiness. Enjoy this episode. Let’s begin.

Hi, Kek Wee, good to have you.

Kek wee 02:15

Nice meeting you, Kai Xin.

Kai Xin 02:16

I understand that you’re the head of investment research at Unicorn Financial, and you’re helping millions of dollars of money. Must be quite stressful, isn’t it? How do you stumble upon this role?

Kek wee 02:31

I’ve been with Unicorn Financial Solutions, or at least in this current team for 16 years now. This is my 16th Year. I used to be an audit manager with Price Waterhouse Coopers. What actually got me started was with myself. I learned the value of money, probably at a young age. So the moment I started work, or even before that, I took part time work, so that I can save. And the moment I started working, I just didn’t want to have money problems. And then I started to do my own financial planning. I started to invest, although at the start, I wasn’t successful, after I learnt from Warren Buffett from his book, I think it (investing) went quite well.

And you know, one of my main thing about work, the real work in my life is really satisfaction and fulfilment that is beyond the money. I’ve always been thinking to myself, you know, if one day I do need to work for money, what would I do? And as I became successful, managing my own money, I started to share with people quite naturally. And I see they started to action, actually got me quite excited. You know, when I’m able to help people in this area, there’s a sense of fulfilment. But I didn’t know that was such a profession last time. So, then I just thought like, well, if one day I can be financially independent, I’ll just do this for people out of goodwill. By the end of 2006, I realised that actually I can do it as a profession, and I started to help people plan for their finance, and their investments. And over time, I think my skills in asset management got better, and I think the organisation needs this specialisation and leadership in this area. So I kind of just transit into this role of managing the whole, all of our clients, a few 1000s clients’ wealth. So that’s how I transit into my current role.

Kai Xin 04:38

That’s very interesting. I’m wondering, what got you into feeling excited? Like why do you feel excited about managing wealth? Because you’re practising Buddhists, right? And I think sometimes people have the misconception that Buddhists is all about letting go. We don’t really have to plan so much or accumulate wealth. So, what keeps you excited?

Kek wee 05:02

At first was nothing to Buddhism. I just thought that. Well, I see people have been problems over money. I like a quarrel over money. Not enough money. So I thought that, well, if I can get this problem out of my life early, that’d be great. Hence, I started to be studying into it, researching how I can be doing it for myself. Then I got started. There was one incident, I was sharing with one of my junior college friends. I told him what I was doing, and he said, ‘that’s very good, but I don’t know how to invest’. So, he passed me $30,000, and out of goodwill, I helped him to invest it. I understand this is not quite allowed. And then, two years later, 2006, I met him again, is getting married. And he looked quite worried. And I said, ‘you’re getting married, why you look so worried?’. He said, ‘With marriage, there are a lot of things, a lot of outflow. I need to plan for my wedding band, my wedding banquet, my honeymoon, my HDB unit, my renovation. I looked at my bank account and I don’t have enough money.’. And then I told him, he’s got this money with me at a time it has grown to just slightly below $50,000. So I said, ‘If you want, I can write you a cheque the next meeting.’. So I wrote him a cheque. I saw his eyes lit up. It is a sigh of relief for him. So at that moment, I thought that if I can benefit people with what has benefited to me, it’s going to magnify my whole fulfilment: to be able to serve people, in addition to serving myself. Hence, from that point onwards, I found my answer. If one day, I do not need to work for money, this is what I’ll do. I help people to discover and to take care of their own money, so that one day they don’t have to worry over it. And then they can lead their life well, because of that, eventually and quite inevitably. So I came into what I’m doing today.

Kai Xin 07:16

What I’m hearing is that you’re saying money can solve a lot of problems. And I think some people might also think money can be the source of many problems. What are your thoughts about that?

Kek wee 07:29

I always think if money has a voice, now, I think he’s going to protect protect his innocence. So you know, it’s not me who’s causing you all the problem, you are causing the problem and making it making me the scapegoat. So I really think our life problems come from our wrong view, or in Buddhism, we call it our ignorance. And of course, you know, sometimes we pin it on money, that money is the cause of it. But money isn’t; it seems to accentuate our problem or accentuate those evil because it’s like a tool.

I saw this advertisement, an education advertisement. The advertisement shows a boss bullying this person. Then, this person, made a wish, ‘I’m going to upgrade myself. And one day, I’m going to be above you. And I’m going to terrorise you back.’. Of course, he doesn’t become a bad person, the moment when he becomes his boss’s boss. But he became that bad person, when he have that thought that one day, he is going to get better than his boss, and he is going to oppress him back. So I think, you know, a lot of these problems do not come from the money, but because of our view towards it.

Kai Xin 08:34

What would you say is a right view, or right way to view money?

Kek wee 08:40

Well, I think a lot of people think being rich, is that main aim and they end up being the slave of money. So they start to do foolish things. For example, like they work hard to earn money they don’t have in order to impress the people that they don’t like. Or they start to risk money that they need, in a hope to get money that they don’t need.

There is this interview of Warren Buffett, Warren Buffett is the sixth richest man on earth, a very successful investor. His net worth is about $110 billion. He shared a story of the metaphorical gun. So the interviewer asked him, ‘Warren, if I were to put a gun here on the left and a billion on the right. So this gun got six chamber, only one bullet. If you take up this gun and pull against our temple, if you’re not dead, this $1 billion is yours. Warren, would you do it?’. Warren Buffett said, ‘I won’t’. ‘Say well, what if I changed his gun to 100 chamber still only one bullet, will you do it? The risk is much lower.’ Warren buffett said no, and said, ‘you can stop trying. You can put 1000 chamber, a million chamber with 1 bullet, I still won’t take up the gun and pull against my head for the $1 billion.’ And the reporter asked why. He said, ‘you look at me. You know I’m already at this age. (Now he is about 90 years old). I have $110 billion. What is the use of this additional 1 billion to me? I probably won’t ever use it. But no matter how low the risk if I think that this gun and pull against my head, there is a chance that I will be dead. Why will I take a risk for something that I don’t need?’

I say most people won’t think this way. If you give him enough odds with a billion on the table, no matter how rich he is, whether he’s gonna need it, he’s going take the gun and pull against his head. So people lose track of money. Their eyes are on the money, but they forgot what is money for. The thing is when money is not the main thing, it should be there as the byproduct, byproduct of our service. Because in ancient times, you know what, actually, if you take a look what is money, ancient times? Money is a substitute for barter trade. But in the old times, I would work hard to grow my crops, you would work hard to grow your crops. And because I want to have a variety, I would exchange part of my crops with you. And money subsequently evolved as a medium of exchange. Hence, money is actually an exchange of service.

So, I believe the Right view to money, to wealth is, in fact, to be happily serving with kindness, to solve other people’s problems, be a solution to other people’s problems, and money will come. And it’s actually very in line also in the Buddhist view, because I was listening to a talk from Ajahn Brahm. He said that one of the key rules for both monastic and laypeople is kindness. And I think service is an expression of kindness. Because if I were to say that I’m very kind to you and I love you but I choose to do nothing for you, then I can’t express it. It’s just all in my thoughts. So, I think service is an expression of that kindness. And money is a consequence of that service. So then, if I choose to focus, not on the money, but I choose to focus on being kind, and expressing the kindness through service to others, and also to myself, then that’s where money becomes incidental, is no longer an aim when it comes by itself. So, that is what I think about money.

Kai Xin 11:59

Theoretically, I think it sounds really nice that money is a byproduct, and we can just be kind and money, which has automatically appear in our bank account. But I also know people who are not very deliberate with the way they plan their finances. So, they can be very charitable, and they always give and give and give. And they give to a point that it compromised their own well being. How do you reconcile that with what you’ve just said?

Kek wee 12:28

So, I think there needs to be a wisdom to that. I think that’s actually incremented stage to do this. Example, when you go to the aeroplane, and they would always show you the emergency landing. When the the oxygen tank comes down, what does it show? Do you put on the mask for your child first, or do you put on the mask for yourself?

Kai Xin 12:50

For myself.

Kek wee 12:51

For yourself right? Because when you put on the mask for yourself, you’re safe, you have the peace of mind, then you can look at helping others. And it’s going to be done more effectively as well. So, I think there needs to be a certain wisdom towards the use of money. So, when the money comes in, I think I need to be saving that money. And it’s not that every cent goes out, come in, you know, go out to help people. And worst still, even borrowing money to help people. Hence, firstly, we need to get ourselves stable, then we can help people effectively.

Because we talk about the four types of people.

There’s the first type of people: they don’t help others, you don’t help themselves. These are the very selfish people. They have got no use in this world because they are so selfish.

The second type will help themselves, but they are not willing to help others. So such people, they can survive, but they won’t live very well. And the world won’t benefit because of them.

And the third type is to help others but they don’t help themselves. Such people can can’t people for very long.

And the fourth type of people is where they help themselves and help others. That’s where they can really help people for a long, long period. And they themselves will be very settled.

So I think this applies the same for money management. After we work hard, we serve other people, then money should come in righteously. With that, to be saving up. Then, from survival state to a state of comfort, then to a state of where I feel that I have enough for myself. And I don’t think there’s a need to fill up my life as I earn more money.

So I always have this believe that how I live my life, and how much money I make is independent. As I get richer, it doesn’t mean I need to change from a kopitiam coffee to a Starbucks coffee. If I like Starbucks, I can drink Starbucks. If I love kopitiam coffee, I don’t have to purposely go drink Starbucks just because I’m wealthier. And then I keep my life the same. I enjoy my same work, and I enjoy serving myself. Serving myself actually means keep upgrading myself, learning spiritual teachings, learning to have better relationships with people. It’s not indulgence, just in case I transmit the wrong idea. So serve myself, serve other people. Then, with the access after I have enough for the life that I want, which, for me is to lead a simple life, if there is access, I would have the freedom to help other people. And to help other people also requires wisdom.

Because I think it’s something quite logical. A story that’s often told, there’s a gambler who wants to keep borrowing money from you, and you keep lending him, you’re not really helping this person. So we can be very generous, but we are not doing very wise, doesn’t mean if I’ve got money, I can anyhow splurge to help people, I need to be a good steward of money. I need to know when to be giving, when not to be giving, to have the best effect.

Kai Xin 15:52

You mentioned that we first need to save ourselves before we can save others, talking about saving ourselves in finance, it’s about also how we save money and not to spend too much and to splurge. But sometimes it can get a little bit stressful, like I download a financial tracker, that every meal, I would key in the money and then I get very uptight with the way I spend, then that causes a lot of problems, also, because I might get calculative. So maybe I don’t enjoy as much time with my friends, when we have a proper meal, it might be a little bit costly and in my mind, I just like calculating, say I shouldn’t be here. And it’s not very wholesome also. But then on another hand, you mentioned, if I originally like the kopitiam coffee, then I upgrade to a Starbucks coffee, then do I need to do that? But that’s also what we see isn’t it? As people get more wealthy, their lifestyle kind of change, and their expenses would also increase. But is that wrong? Then, how do you draw the line between being too stressful over money and being too free and say money is mine, I deserve this. Otherwise, if I die, I’m not going to be able to spend it? How do you balance these two?

Kek wee 17:10

Firstly, okay, I’m gonna share my own life for maybe that is a bit practical and realistic. So the thing is about, I think, to love my life, as it is. Actually money and life are so intertwined. It’s almost impossible to just talked about money, and not talk about life. Some people talk about, oh, I want to save more and more money. So actually, I did this planning for a client before he came to me. He’s a polytechnic lecturer earning about $9,000 a month. That was 20 years ago, and he couldn’t save any money. So he asked me, why is it like that? And I asked him about his life, what is his lifestyle, so I prescribe certain change to his lifestyle. For example, instead of going drinking with friends every day, maybe change it to three times a week, or moderation. And then enjoy other things such as having a cup of coffee with a friend instead of going to a pub. At the start he said it is a bit tough. There’s a change of lifestyle. But surprisingly, a year later, I asked him, he said, ‘actually, I find that I do not need to check my expense anymore. Every month, I just spend as I like, and I can save the amount that I want to save.’. So, it’s not about forcing ourselves to scrimp and save. It’s impossible. It requires a change, and to enjoy a new kind of lifestyle.

I wouldn’t say we have to shed the things that we love to do, but rather it is to adopt and enjoy a new kind of lifestyle. And it’s not just lifestyle, I think it’s everything in my life. Maybe I can start with work, then with relationship. I enjoy my work a lot, you know, because I see it as a form of serving, serving people. Because I manage now about half a billion. And I’m very grateful, my company gave me this opportunity. And I know that this half a billion represents many people’s hard earn money. And if I can take care of it, well, I feel very fulfilled, and also it is also making my colleagues’ job easier, because they are the one who are going to face the client. Because of that, I continue to enjoy in progressing myself. I would listen to the financial news, I would upgrade myself, I would talk to people who are in this field, who are better than me. I learn from them, so I can do a good job. Sometimes I may make some mistakes. And of course, we have other people to help me ringfence. Make sure mistakes don’t get too fatal, but I don’t beat myself over it. When I make some minor mistakes, I learn from it. I don’t beat myself over it, I continue to enjoy what I do. And then I start to also impart my skills to my team and help their life get better. I enjoy this whole process.

And I enjoy associating with friends whom I like. In the Dhamma, the Buddha said one of the most important things, is having the right association. And sometimes, having this right association, also learning how to get along well with them, with people closest to me: my wife, my parents, my colleagues. And if I can cultivate great relationship, as I say, you know, having a $1.30 Kopi-C in a Kopitiam far surpasses having a $20 cup of coffee in Ritz Carlton with someone that I don’t like. If I can enjoy my work, learning on my work, enjoy the relationship with people that matters to me, I find very little need to spend money.

And because I enjoy this simple pleasure, I don’t need to spend a lot, and I get even better happiness out of it. And because of that, I continue to do my work well, I serve people well, when I do that, actually money comes to me. I don’t go out there and search for it. And when it comes, I don’t deny that. For example, because in my role is quite a performance based. My income is coming from a part of the company’s profit. And I get to allocate how much I should be getting, of course with other people and with my superiors’ approval. I don’t shortchange myself. If I think I’ve done well, and I should be getting this reward, I allocate that to myself. Ajahn Brahm said this previously as well. He said that a lot of people deny compliments. ‘Oh, you are very good. You’ve done so much for us.’. A lot of people like to deny that. ‘No, no, no, I’ve not done much. You know, it’s all other people’s credit.’. Ajahn Brahm said that if you think you have really done that, just accept the compliment, don’t always push it away. Example: If I’ve really put a lot of effort, I’ve created value, I should allocate a fair amount for myself. I don’t shortchange, I don’t deny myself in the area. So, when I serve, I get the money. When I love my work, I love my relationship, I take great happiness and pleasure in simple things, which don’t cost a lot. Sometimes, well, if I say my friends wants to go to a nice place. And because I earn much because of I serve people, I spend little because I just spend so much hour at work already because I love my work, I really don’t have much time even it’s just to spend outside. And hence I have lots of surplus. And when that’s needed, well sometimes people think that today, I think I want to go to a nice place. I have no problem.

Maybe let’s talk about an example. I was with my wife after lunch to buy a cake. And the cake was not very cheap. One small piece is about $4. So I bought three pieces. In the past, actually somehow to think – wow, $4 is a little expensive. Maybe we can just go NTUC, you can get more for less. But because overtime, I do what I’ve shared with you, I just pay for it without even thinking much. So, I shared my wife that sometimes just having that resource, give us that choice. I don’t have to think about whether I can afford or should I go somewhere. I just pay for it. And hence, it gives me that you can say a peace of mind. I don’t have to worry if I buy this cake will I have enough for my dinner later. So, I think that is the purpose of money. It is just a resource. And I don’t have to use it up in my whole life. If after I’m dead, there’s still let’s say a couple of millions or a few million left over, so be it. I don’t have to expand my life. I don’t have to eat at Hotel every day, because I worked so hard for my money, I feel a need to utilise every cent before I die, otherwise, it’d be a waste. I just I just enjoy my life, as it is. Enjoy the simple pleasure, which doesn’t cost much. And incidentally, we don’t have to plan very much, a lot get left behind every month. That’s my experience.

Kai Xin 23:35

It’s like the real question isn’t so much about how can we save money or how can we accumulate wealth. But more of why are we doing that for? And if we can turn the question around to say, what is it about my life that I want to enjoy, and how can money be the resource to help me enjoy it, then it would not just make us feel more fulfilled, even if we have less. And if we have more than it’s a bonus, and don’t shortchange ourselves as well. I personally think that this is quite a mindset shift. Because sometimes we are too caught up with money to say, ‘Okay, everyone seems to be doing the nine to five job or they’re striving to accumulate wealth and to invest’. And sometimes greed gets in the way. And you see like the market is very volatile, and then you get very emotional, or maybe you see a good opportunity, then you want get rich fast and you jump on it. But it creates a lot of stress. If we just identify that hey actually wants all this for? It’s about happiness, and I want it to be more sustainable, then we can pull ourselves back a little bit and like Warren Buffett’s said, assess the situation to say, is it really worthwhile? Maybe not.

Kek wee 24:44

Maybe I put it as a four step process. We can talk about how do we go about thinking about money. So I think the first two, I kind of shared. The first one is really money is an exchange for service. You can be doing the same thing, but just a thought is different. I give an example. Instead of thinking how am I going to climb the corporate ladder, which is ‘me’ focus. ‘I want to climb the corporate ladder, because I want to get the title, I want to get more money.’. And that comes with a lot of stress, which means I may need to do some things which are not so right. I might have to step on other people. Or I can be thinking, well, I want to serve the organisation better. So I better upgrade myself. Then I see, this is what’s lacking in the organisation, I’ll upgrade myself to fill that role that is needed by the organisation. So that the organisation can in turn serve customers better. I see a need of my colleagues, I want to upgrade myself to help my colleague, so it’s not to compete with them. Then, if I can be a start of this culture, I can also influence the whole organisation culture. So you could be doing the same thing, but with a drastically different mindset. And it brings a very different emotion and feeling. Instead of competing, instead of being very self-centric, thinking a lot of gain and loss, it becomes very that of serving. That I put myself smaller, I’m here to serve what the organisation needs.

In fact, it’s about self. The less of self, the less suffering you have. And that is the basic principle of the Dharma, that I’m willing to be serving people, and then learning things along the way, how people solve problems. And naturally relationships get better. If I help all my colleagues, rather than compete with them, then I will have a better relationship with them. And worst comes to worst, if it is a toxic place, then maybe I have to leave also. I’m not saying that it’s not an option. But I do what I can first, I can shift my mindset, and I serve. And I believe, you know, if I’m in a right place, and if I serve, I would be a solution to other people’s problem, Bosses should recognise that. And if the boss is blind, and maybe I really need to leave. But because I am a boss, I am in a such a role myself, such people are very hard to find. I can say maybe unfortunately, in a more self-centric world, we are today, people who are giving, people who thinks for other people, people who are willing to do more for the greater good, is very hard to come by. If I choose to do things with this mindset, actually, I can do more. Others are happier, I’m happier. It’s a win-win situation.

Kai Xin 26:40

Before you go into step two, three, and four, I’m just wondering whether the exchange for service has to be strategic as well. Say, sometimes we can be serving and be very giving in an organisation, can we also have the intention of serving while wanting to get a promotion or get a bigger paycheck? Of course, not at the expense of other people’s happiness. And can we also be more strategic as to whether we are in the right position to serve based on our skill set and our competencies and our strengths?

Kek wee 27:59

I really think it’s fine. I mean, it’s sometimes about communicating. I think go back to the points, like, you know, like Ajahn Brahm said about, there is no need to deny compliments to myself. I think it is perfectly alright. If I’ve done this for the organisation, I think it is perfectly alright to say that this is what I’ve contributed. And then if others, you know, let’s say the management wants to assign a reward for me, I should accept it. There’s no need to deny it. And if it comes lesser (than what we want), I think there’s no need to be too hard about it. I believe if we just continue doing the right thing, then the the right thing will come upon us.

Kai Xin 28:38

I do feel like it’s a little bit idealistic, because sometimes people might not be very proactive in asking. For example, asking for a promotion or negotiating for pay because they are too selfless. I guess also, maybe it’s a lack of confidence, or like, oh, I don’t deserve it. And people can get taken advantage of in an organisation. Perhaps somebody who is contributing less, just have more guts to ask for it, then what would you say to that? Because it cannot just be okay, sit back, and if it comes, it comes that if it doesn’t come, it’s okay.

Kek wee 29:13

So I think the firstly, it is the communication. Because sometimes, let’s say the management or my superior don’t recognise, it’s not because they don’t want to recognise. It might be because they don’t know that I’m doing all these things. And worst still, sometimes people think, I do so much for you and you don’t recognise. Why should they recognise? You don’t even tell them. And you expect them to know that you’re contributing all these things. And they may not even know the effort, the hardwork behind all these things. So, I think for the first thing to do is to be willing to communicate – We’ve done this project, I’ve done all these things. And this comes with a relationship. I think about a win-win relationship with my boss. And this makes the communication easier, and this will make it easier for him to see what I’m doing.

So, I think that personal and professional relationship at work cannot be separated. Because if we only choose to do my work very well, very professional, but I have got no personal relationship with my boss, there is a very good chance that he’s not going to see what I’m doing. I mean, he’s got a lot of things on his table, I believe, as we get more senior. So I cannot expect, I cannot demand that he knows what I’m doing. I think it’s to have a personal relationship. Sometimes it is over coffee. It might not even be telling him/her what I’m doing. It is just to learn from him: ‘This what I’m doing, how can I do it even better, that I’m supporting you in this.’.

And then, as I said, we want to see the other way, over time does this person reciprocate? I think we’ve got to give time. If the first few months, the person don’t reciprocate, I think it’s too unreasonable to expect of the other person. But after a year or two, and it is quite evident, this person is just taking me for granted, or worst still, exploiting me, then I think it is to make the option to leave. So, that’s why I said that is definitely an option. To find a good fit, to find someone who can recognise my talents, my contribution. Maybe I just put it as I shared, maybe summarise it.

So first, I think is to serve, to learn, and then to communicate through a personal relationship. And then after that, over a reasonable time to assess for myself, is this place where we want to be winning together? Are we mutually appreciating one another? Or is it an exploitative relationship. And if it’s exploitative relationship, firstly, the company usually won’t survive for very long, because all the good people will leave. And then, it is really about finding a place where we want to build the future together. So I always see myself together with the company. I’m not away from the company, so I help build the company. And hence, so I’m doing things WITH my boss, not FOR my boss.

Kai Xin 31:59

With, not for. Very important.

Kek wee 32:01

I have observe it personally, myself, such people are just so hard to come up with, so hard to find, and if the boss still don’t want to recognise someone like that, then the boss I think, is quite blind. I think the person should leave.

Kai Xin 32:21

I think it’s to have that wisdom to recognise, and a lot of heading a win-win situation. So tell me more about step two, three, and four.

Kek wee 32:30

So the second part is really about serving happily. So actually, my happiness should be now it’s not in the future. That means I am enjoying what I’m doing now. It’s not that I’m sacrificing now for a happier future. I’m already happy where I am. And because I’m happy where I am, the byproduct is, I don’t have to spend a lot of money to find my happiness or pleasure. Because I’m already happy, I’m happy. And we tend to already invest a lot of time in areas that we are happy, right?

If I love my work, I guess you as well, I see that you’re someone who also love your work a lot, love contributing through your work. Actually by itself, our work is our hobby. I mean, we love it a lot, and we will keep researching, and learning. And that itself is happiness already. And if better still, I can have great relationship to cultivating with my loved ones and my colleagues, actually, really, this is called a Simple Life. A simple life is not about doing nothing. It’s about actually doing all these things right now: by being present. That means building my life right now, not somewhere in the future. Then, I will enjoy my life now. And it is also my personal experience, I have little need, and sometimes also little time to be spending money. So in my life, I see that I do not need to go to a nice holiday, I don’t need to go to a nice restaurant to make me happy. Very low cost things are able to make me happy. And the byproduct is that we can save.

And then the third one is, of course to invest. But of course if a person has managed to save up a lot, you can also don’t invest. I mean, if you have a billion dollar and you don’t invest, that’s fine because you’re not going to use them up a whole lifetime. But I think for most people to invest the money is being practical. Just minimally to make sure your money doesn’t get eroded by inflation.

And secondly, it is also because I am happy where I am, I am not eager to get out from where I am, why are people impatient and why do people fail in investing? Because they want to get rich quick, because they can’t stand low returns, they want to have high exciting returns. And why is that? Because they’re trying to get out of something which is the current state. So they think that when they have their money, their current state will change. That’s the purpose, right? When I think I have money, my current state will change because I’m suffering now. And they want to get money quickly. A lot of times the risk comes with it and the failure comes with it. But if I’m not in a hurry to get out of anywhere, I’m happy where I am I can allow myself to be very patient investing with just a 3-5% return. But to some people seems very little. But it is okay if I’m already enjoying what I’m doing. I just let my money compound slowly, taking very little risk. And that’s, I think successful investing.

At this point, let me share this. There was this conversation between Warren Buffett and Jeff Bezos. Jeff Bezos, I guess most people know who he is. He is the founder of Amazon. So one day, Warren Buffett was sharing his way of investing with Jeff Bezos. And after sharing, Jeff Bezos asked is that it? What you’re sharing seems very simple. Why aren’t more people following what you’re doing? So he said that most people don’t like making money slowly, making money slowly doesn’t mean make very little money, otherwise he wouldn’t be where he is. But it means he’s willing to be patient to let his money take the time to do the work it’s supposed to do. In Chinese, we don’t 拔苗助长. We can then afford to take very little risk for reasonable return, unhurriedly. So even with the big up and down with the market, I don’t get so disturbed as well. Because I’m happy doing this even for my whole lifetime, and I don’t need this money now. And hence, I can let the money grow at its own pace. Even if it goes up and down, it doesn’t bother me that much. That’s why I said successful investment, and the right way to lead our life comes together.

- So I talk about serving, so that we can get income.

- We talk about saving part of the income and naturally by just enjoying and be happy with what we are doing.

- And thirdly, by investing right. Again, by being patient: because I’m not in a hurry to get somewhere. And then with these things are done, I think most people should be reasonably wealthy in my view, as a byproduct. Not because I’m clamouring for it, but it just go by itself in the background.

- And then lastly, is stewardship. What do I do with all this money?

And I think there’s a research that shows that for men, successful men, who are very driven, let’s say by 45, they want to be a successful business, and by 45 they build a successful business, and then they sold their business for huge handsome profit. And if they have no other purpose in life, most of them after they get this windfall, what usually happens? The first thing, you indulge in material things: buy flashy cars, buy properties. And then sometimes I heard from people this car, they don’t even use it, they don’t drive on the road. They just park it in their house. And this is in the research, they say that because the metal can’t talk, these man would start to look for a woman outside of their own marriage, and to find excitement. And that cause the downfall of their marriage. And after that, they want to seek challenge. Because they are bored and these people are driven, they make their money early, and that’s when they go to the Casino. And sometimes they lose all the money away. So I think that’s about self indulgence, where I build wealth for myself. And then that is one outcome. The other outcome is that they keep expanding their life, feel the money they have, because they think, ‘now, I’m a multi-millionaire. Hundreds of millions. I can’t be living a life like that, right? I can’t be having coffee, eating porridge, living in a HDB unit, so they start to fantasise – I need to eat seafood everyday, I need to only drink coffee from a hotel. I need to go for this, this, this holiday. Actually, they screw up their life, because they made too much money.

I’m going to share two examples with you. First one, you’ve probably experienced also. Buffets – especially my younger days. I pay money to go buffet to torture myself. At most I paid $20 And I stuffed myself to the fullest. I feel terrible coming out from that restaurant.

The second one is a friend. So I met him once. He’s 30+ years old, early 30s. And so he shared with me right where he’s working I asked if this is his first job. He said, Yeah, I just graduated. And I asked if he studied PhD until 30+ years old? He said, “No, I just studied PhD.” If you don’t mind, then can I ask, why do you graduate only at 30 plus. So he said, I got too good a score in my junior college. And, because he got too good a score, the subject he really loved to study, and to do, is too easy to get in. So he didn’t choose the subjects he loves to do, they end up choosing the most difficult subject to get in. So that because he got such good score, he doesn’t want to waste his score. He just did something he didn’t like, just so as to not waste the score instead of doing something he liked. After he finished studying, he still realised that what he loves to study and do, is still what his former interest is. After graduation, he went back and studied what he love, and wasted a good three, four years. So again, he was trying to maximise his marks to study something he doesn’t like, and then wasting a few years. That’s the same for money, some people want to maximise the use of money, and end up altering their life to their own unhappiness.

Kai Xin 40:06

When you were sharing about the research, interestingly enough, there is actually a sutta called Parabhava Sutta: Downfall, when the Buddha talks about the same exact consequences, where a person who is a gambler and squander all that he earns, this is the cause of one’s downfall. Or that they’re not contented with one’s wife, and then you know, start looking for others, this is the cause for the downfall.

Kek wee 40:30

You know, the Dharma is really the truth. But it’s how to then apply it in our actual lives. There’s the stewardship, then how to then make money be very fulfilling. I can just live my life, independent of how much money I have. If I love to live in HDB, then I can continue to live here. I don’t need to upgrade my house, then that’s where we’ve got more money, then this excess wealth that I have, that I don’t need, then that’s where, you know, I can look at doing really purposeful and useful thing. Like see, like, what Bill Gates is doing. I mean, he built Microsoft, now doing full time philanthropic work, hoping to be solutions to some of the problems in this world. I think that’s where money can bring us fulfilment and happiness, where we have the right view towards it, and use it properly, not to self indulge. So I think that’s the four parts about money.

Kai Xin 41:24

And I believe you’re you told me you’re living in HDB right.

Kek wee 41:28

Yeah, I really plan to live here for the rest of my life.

Kai Xin 41:32

So I believe you’re also like, probably a million, I think more than a millionaire. And yeah, I think that kind of like contentment and fulfilment. It’s so important. I just wanted to ask you a little bit about the stewardship part, do you mind elaborating on how people would be a steward of their wealth?

Kek wee 41:52

Stewardship means I’m taking care of it. It’s not mine. It’s really not mine. I mean, we walk into this Earth with nothing, we will leave this world with nothing. I just care take whatever, few decades I have on this Earth. And money is one of the items that I can take. So if I have these thoughts about money, then firstly, I wouldn’t be just chasing this money, because I’m just temporarily taking care of it, but neither will I be negligent. And then it’s also my goal, to make this money productive. When these come to my hand, I don’t allow it to be depreciated in value, at least I do my best to keep it safe and safe against inflation as well. And then that’s where it’s not mine, I’m safe keeping it and then I need to learn the right purpose of it?

Let me share an example, I had this friend that was very kind hearted. And then one of his friends, of course, who knew his soft spot, and started to share a lot of stories about himself. So my friend really sympathised with his hardships. And then, one day, he wanted to borrow money. So to solve some of these problems that he has. And my friend, being very soft hearted, kind hearted, lent him money, up to a point he wanted to borrow money to lend his friend. That was where I woke up as well, and I asked him, actually how much have you been lending to this friend? He said half a million? And you want to borrow more money to lend this friend? Because he really needs help? Have you ever checked any of these things that he said? Is it true or not? He said, he never checked, because it just sounds so true. I’m not obstructing him from doing something good but at least go and check out some of the things that he said. As some things can be verifiable, you can call the hospital, you can call the MP. And with the first check only, he found out that it was a scam. Now, of course, he got very upset being used by a friend. So I shared with him. I said, you know, you have a very giving heart, which is great. But we still need to use our money wisely. We want to help people we need to use it wisely. To really be able to help will require allocating the money wisely. That’s stewardship – taking care of this money. So I need to be using it wisely. Compassion has to come with wisdom. It’s not just compassion.

Kai Xin:

Totally agree. I got scammed so many times until I learned the hard way.

Kek Wee:

So it’s always to verify and yeah, I think whether the money that you give to somebody, they can take care of it as well. Very important to assess. And the best is given to people who can further propagate Dhamma. But I think that’s also I guess it’s in the Dhamma as well, right? Where if we serve people, let’s say like the Sangha who live very well, through them we can probably get much much more benefit to people, rather than giving the same food to someone who only is caring about himself. So by giving someone who has a big heart to do a lot of things for more people, then the same contribution is going to benefit for many more people.

Kai Xin 45:05

We agree. And can we backtrack a little bit to what you said about Warren Buffett, he mentioned, or you mentioned growing money slowly is not the same as growing little money? Can you share a little bit on that?

Kai Xin 45:21

I think the patient comes with knowledge as well. You’re knowledgeable, you make an informed decision. Even if the market is volatile for a short while, you would naturally feel certain about the long term result, because you already did your homework. And I was just thinking about when people talk about wealth accumulation, they are a little bit afraid to dabble into investment, because of a lot of unknowns. And personally, I’ll just use like, say, my family members, parents, for example, very traditional. So you kind of exchange time for money with hard labour one hour , X dollars. And investment seems like a concept that comes with a lot of risk. And just wondering for people who wants to start investing, because that’s one of the four steps that you’ve mentioned. How can they do so wisely? Where should they begin?

Kek Wee 50:37

So, the risk is always the investor, never the investment. I see so many failing in investment, but yet Warren Buffet can do so well. I can say the same for my own experience. My first two years was absolute disaster. And subsequently, I was doing pretty well. It’s not that the market has suddenly changed. It’s just that, you know, I have learnt the the right way of doing things. In fact, actually, when I first started investing, my parents was very, very against, because they have kind of speculated in the Malaysian Clob issues, they were alot of Singaporeans speculating in Malaysian shares in the 1990s. So they were burnt there also. So when they know I was buying stock, they were very concerned. And my mom was trying to persuade me out of it. So I have to have two sides. One is my mom’s, one is Warren Buffett. And Warren Buffett’s say about investing is so rational and low risk. I mean, well, you are just a shareholder of a company. And as a shareholder of a company that you use the product more and more, then you should be really certain about a company. That’s at least the first step, and then it’s about getting yourself more and more knowledgeable. And then you’ll be able to decipher what is suitable, what’s good, what’s not good. So the first thing to do to make investment less risky, is first learning how to invest. So it’s not too follow hearsay, but to really learn from the foundation. Of course granted, not many people will be interested. Some people just look at the amount of work needed, look at the financial statements. And it can totally turn off as it is hundreds of pages. So I think failing which, there’s two other ways.

One is index investing, which is mainly just investing very broadly. And then just just leave it there for a long period. That over time has proven, it will do well. However, people could still be very emotionally disturbed, because volatility can be large, especially when a person just started and happen that the market has a big downturn. And then you start to determine is this correct or not. But sometimes, you may also be good to really have some professional who has been through, you know, cycles, to be able to partner this person. Yeah. Such that it’s different right to have a different person who give you the assurance and someone that you trust, versus to have no one to lean on, and only listen to stories, to listen to hearsay, to only watch the TV, the news, investment is the same, but it’s about the emotion. Yeah, if you’ve someone you trust, who can do that with you. And he’s doing the same thing as what you’re doing and can be successful for a long period, then he helps a person emotionally easier to get through all this volatility. In essence, either you DIY, to get competent him or herself to know what this thing really is. A it’s what stocks really is or get someone to help them, I feel these are the two ways to do it. And then really invest time getting to know it. Don’t be in a rush to invest money, put money, especially when you see people are making a lot of money. I really think the most important is to take the time to really figure out what is suitable for yourself to learn about it. That’s where risk can be very much reduced.

Kai Xin 54:07

To add to that, I think it’s very important to also only invest what you’re ready to lose in the short term, right and not just put all your eggs in one basket? Because I know some people they do that.Yeah, thanks a lot, Kek Wee. It’s been a really insightful chat. And I know you are also running classes. Where can people find more or to learn from you in terms of investing?

Kek wee 54:33

Oh, yeah. So actually, it was about two years ago, that we started this online investment class that’s based on the curriculum by the Institute of Banking and Finance. So based on the curriculum, I just set up a class so that people can sign up to learn about basic value investing, if they really want to consider the DIY path. If you are interested to want to learn about investing, you can go to the GreyRhino.sg and there you can find the online investment class. You can read about it and sign up if you want. I also do a fortnightly video can go YouTube and also search the grey Rhino Singapore. There you should be able to come to the videos that I that I share about the current market and company analysis. Hopefully that can help you if you’re keen to get started on investing. All right.

Kai Xin 55:25

Thanks a lot, Kek Wee. It’s been a pleasure. Thanks Kai Xin. Thanks, listeners for tuning in. I hope you got as much value as I did. Please share with us what is your biggest takeaway you can do so via our telegram channel or wherever you are listening to this podcast. Also, it will be very helpful if you can give us a five star review because it will help us to reach more people. We release an episode bi weekly on either a Wednesday or a Friday. So hit the subscribe button to stay updated. And if you found this episode to be useful, do share with your circle of friends. As usual, the links to the resources are in the show notes. And in our next episode. In celebration of the upcoming Wesak day. We will be featuring some Buddhists musicians from Singapore as well as Malaysia. In case you’re wondering, What is Buddhist music? No, they are not chants they are proper music with lyrics with really good melodies as well. And in the episode you would get to hear the journey of the music producer, the singers the bands and how music actually helps them in the spiritual practice and keep them and others inspired to walk the path. Here’s a snippet of a song called Kataññuta by Buddysings! from Malaysia.

56:46

(song)

Kai Xin 57:07

there’s so many things we can be grateful for. I will see you in the next episode. Meanwhile, stay happy and wise.

About the guest speaker – Seow Kek Wee

As a veteran investor of more than 20 years, Kek Wee is the Head of Investment Research of Unicorn Financial Solutions Pte Ltd, advising and managing assets in excess of $0.5 Billion.

More about Seow Kek Wee & his work:

Useful resources:

7 Secrets to Investing Like Warren Buffett

Special thanks to Tan Key Seng, Lynn Leng, Alvin Chan for sponsoring the podcast!